Explore the CardPower features

-

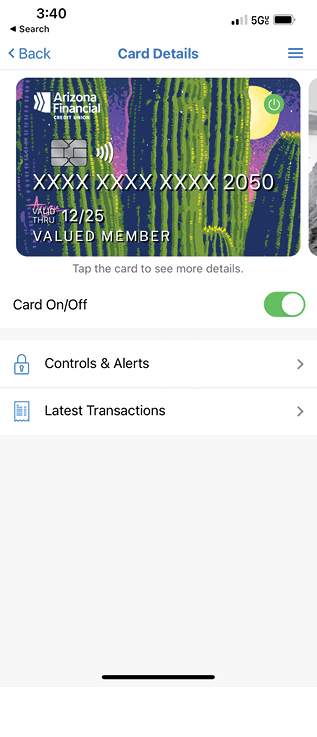

Turn Cards Off and On

Lost or misplaced your card? Not a problem.

Protect your money with CardPower’s on/off switch. Block or unblock your cards with a single touch, until you can contact us for a new card. -

Allow or Block Transactions by Merchant Category

Keep your shopping addiction at bay by disabling specific merchant categories, including grocers, retail stores, gas stations, entertainment, travel, restaurants, personal care, household and more!

-

Limit Card Use to Where You Are

Keep your card active only when it’s in the same area as you. Simply define a region on a map or require your card and smartphone to be within the same vicinity. If a fraudster tries to use your card outside the specified region or when your phone isn’t nearby, transactions will be blocked.

-

Set Transaction Spending Limits

Deter yourself from spending too much, or limit the amount fraudsters can get access to if your card is lost or stolen, by setting spend limits. Use the threshold feature to limit transaction amounts and keep yourself within budget and on track.

Get set up in just a few steps

-

Download the App

The CardPower app is available for Android and Apple devices.

-

Begin Registration

Tap "Sign Up Free" to start the registration process.

-

Enter Account Number

Enter your Arizona Financial account number. The CardPower app is secure and will not share your account information with outside companies or individuals.

-

Enter Last Four Digits of SSN

Type the last four digits of the primary member's Social Security number to confirm your identity.

-

Enter Code

You will now receive an authentication code at the primary member's email address that is on file with Arizona Financial for online banking. Once you receive the authentication code, type the 6-digit number in the CardPower app to finalize registration.

-

Accept Terms and Privacy Policy

You must accept Terms and Conditions and Privacy Policy to complete the registration process.

-

Create Username and Password

Create your username or select the option to use email address as username. Create password and click "Next." Arizona Financial always recommends using a different username and password for your protection.

Usernames must be 6 to 12 characters, including numbers and letters with no special symbols (use 0 through 9, a through z). Usernames and passwords are case sensitive.

That's it! Registration is now complete.

The card summary screen is the default screen that will appear upon log in. Here you will be able to see and select the cards that have been associated with the CardPower app. Select the card to change default settings.

Caution: It's not called CardPower for nothing!- The controls and settings in CardPower are designed to prevent others from using your card without your authorization. That same power could prevent you from using your card if you're not careful!

- We recommend you start by turning on alerts, so you'll know immediately whenever your card is used – and where, and for how much. Then, one at a time, try setting the other controls and preferences until you find what works best for you.

- And if your card ever doesn't work when you think it should, turn off all controls and try again!