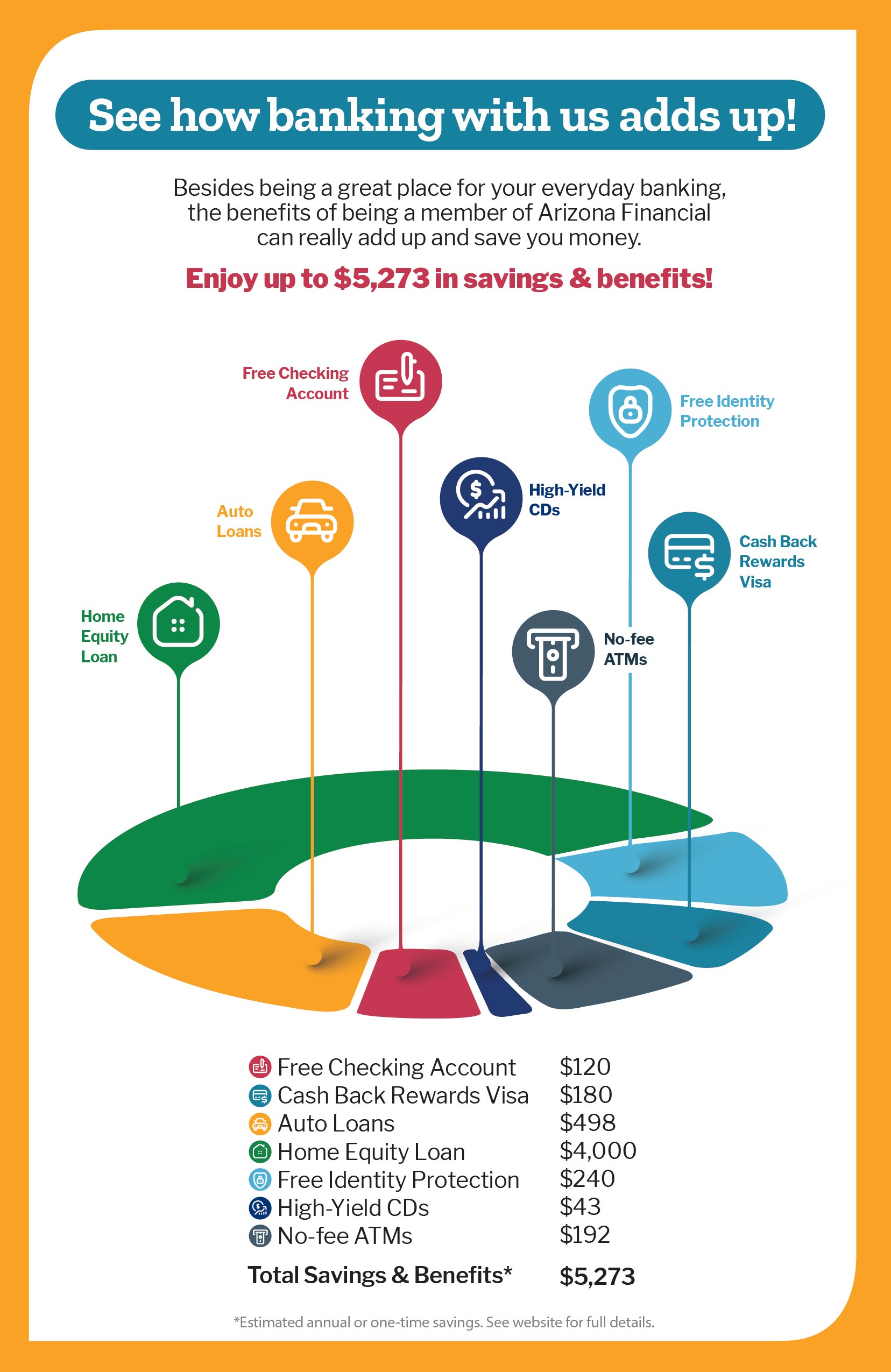

Besides being a great place for your everyday banking, the benefits of being a member of Arizona Financial can really add up and save you money!

$5,000+ savings with member benefits & discounts1

The credit union, as a not-for-profit financial provider, returns surplus capital to members through competitive rates on loans and deposits, lower fees, and valuable discounts and benefits.

> Free Checking Account

With the average monthly fee at top banks more than $10 per month for a checking account, your Arizona Financial free Checking Plus Account could save you $120 in a year, and there’s no minimum balance requirements, unlike at some of the big banks.1

> Cash Back Rewards Visa

In addition to saving on everyday spending with a competitive interest rate and no annual fee, with our Signature Rewards Visa® credit card you can earn unlimited 1.5% cash back on purchases.

Example: If you spend $1,000 each month, you could earn $180 cash back for the year.1

> High-Yield CDs

With our High-Yield CDs you’ll earn more on your money with rates that are higher than the average rates offered at other financial institutions.

Example: For our 11-month CD at 4.75% APY for $1,000, you’d earn $43.46 in dividends. (Average rate per Bankrate is 1.73% APY.) Rates subject to change.1

> Auto Loan Rate Discounts up to 0.50%

Members can qualify for rate discounts of up to 0.50% APR on their Arizona Financial auto loan when they shop through Members’ Auto Center and purchase an auto policy from our insurance specialists.

Example: Save up to $498 on a 60-month auto loan of $35,000 when qualifying for a 0.50% loan rate discount.1

> Home Equity Loan – No closing costs

While the average closing costs on home equity loans and HELOCs can be up to 2% to 5% of your overall loan cost, Arizona Financial offers no closing costs on Home Equity Loans.

Example: For a $100,000 loan with 4% closing costs, members could save $4,000 with our no-closing cost home equity loan.1

> Free Identity Protection & Credit Monitoring Services

Typically, services for identity protection range from $10 to $30 per month. Our members have free access to IDProtect™ services for credit monitoring, fraud reimbursement, plus free access to your credit report and credit score.

Example: If you’re paying $20 per month for identity protection services from another provider, you could save $240 per year.

> No-Fee ATMs

With the average bank ATM fee over $4, our members have access to more than 30,000+ surcharge-free ATMs nationwide as part of the CO-OP ATM network.

Example: If you use the ATM four times per month, that’s a savings of $192 in a year.1

Banking that matters! With our community-focused debit card giveback programs, our members can give back to the community through their everyday transactions with our exclusive debit cards.

> More ways to save

Car buying services

With our partners at Members' Auto Center, you’ll save time and money on your next new or used vehicle by letting them do the work for you! Plus, you can get a 0.25% loan rate discount when you finance your auto loan with us!

Discounted tickets

Get discounts on tickets to Disneyland® and Phoenix Rising FC matches. Log in to online banking and click the “Member Benefits” tab for details.

Debit card cash back offers

Earn cash back with your debit card when you shop and dine at participating merchants. To get started, login to your account and go to Cash Back Offers.

1 Member Savings Terms & Examples

Free Checking Account: Savings of $10 per month based on no monthly service fee. Average service fee at top banks is $10 or more. Arizona Financial Checking Plus Account has no monthly service fees. Fees may apply for certain account services, including stop payment fees, non-sufficient funds fees, out-of-network ATM fees, and overdraft privilege services.

Cash Back Rewards: Based on $1,000 monthly spend for 12 months earning 1.5% cash back or $15 per month and not carrying a balance.

High-Yield CDs: APY = Annual Percentage Yield. Quoted rate is for 11-month term with a minimum balance of $1,000. Other rates and terms available. Dividends accrue from date of deposit and are compounded and credited monthly based on the average daily balance. Withdrawal of dividends prior to maturity will reduce your earnings. Rates subject to change. National average 1-year yield per Bankrate is 1.73% APY as of March 18, 2024.

Auto Loans: Qualify for a 0.25% loan rate discount when purchasing a vehicle through Members’ Auto Center and financing with Arizona Financial. Receive an additional 0.25% discount on your Arizona Financial loan by purchasing an auto insurance policy through our insurance partners.

Home Equity: No closing costs for Arizona Financial home equity loan; property insurance required. Savings based on closing costs of 4% of $100,000 loan amount. Average closing cost is 2-5% of the total loan amount.

ATM Fees: Members receive free, unlimited transaction at all Arizona Financial ATMs and four free per month at non-network ATMs. ATM owner may add a surcharge fee at time of transaction. To avoid a surcharge, members have access to 30,000 surcharge-free ATMs through the CO-OP ATM network.